Business Insurance in and around Kennebunk

Calling all small business owners of Kennebunk!

Insure your business, intentionally

Business Insurance At A Great Value!

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, retailers, specialized professions and more!

Calling all small business owners of Kennebunk!

Insure your business, intentionally

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for commercial auto, commercial liability umbrella policies or builders risk insurance.

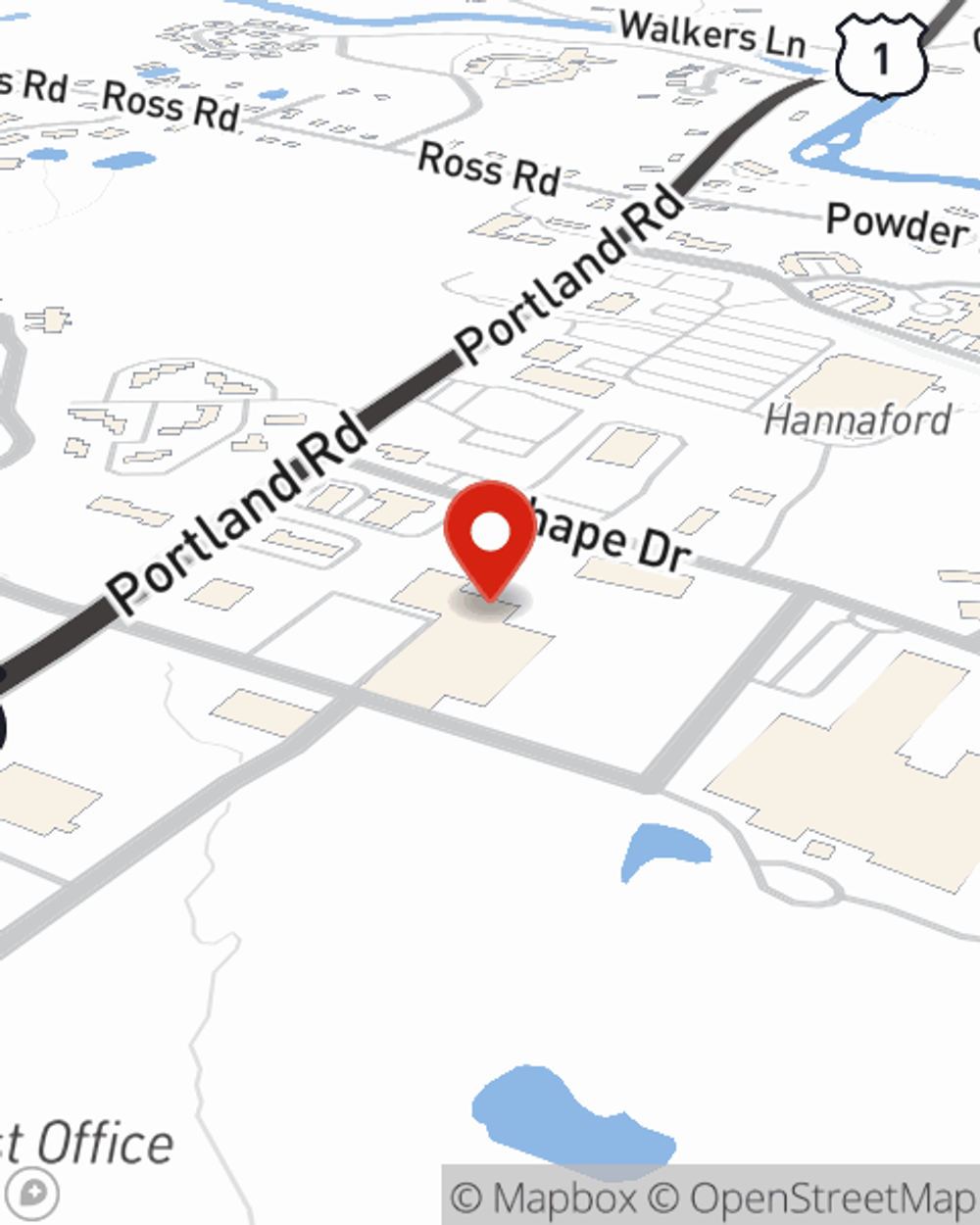

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Tracey Bricker is here to help you discover your options. Visit today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Tracey Bricker

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?